2025-08-11

Spend enough time in crypto, and you’ll notice a pattern: the louder a project shouts “fair” and “decentralized,” the more you should dig into its on-chain details. AKAS Full-Chain Protocol is a prime example making waves recently. Its press releases hit all the investor-friendly buzzwords — global fair launch, no presale, permanent LP lock, up to 30% early bonus decreasing by 0.5% daily, and a “10-level resonance” community reward system — all backed by media coverage. For many who haven’t been burned yet, this reads like the “ideal” decentralized project template.

But as any veteran knows, listening to the story is one thing; checking the chain is another. On-chain, AKAS’s core treasury and token contracts run on a TransparentUpgradeableProxy + ProxyAdmin structure. The initial owner remains the deployer (address 0xe3358…F6411B), clearly visible in the constructor parameters and bytecode. Does upgradeable mean a guaranteed backdoor? Not necessarily, but it absolutely means “logic can be swapped, permissions can be changed” — which directly contradicts the repeated marketing claim of “permissions renounced.” In plain terms: the kitchen key wasn’t lost; it’s still in the original owner’s pocket, just with a different story.

Next, the economic model. On the surface: Genesis LP/node sales, up to 30% bonus, twice-daily compounding (0.23%–0.95%/day), and “10-level resonance” rank progression (V1–V12). In reality, it’s a classic high-incentive referral-driven scheme. This structure grows fast in hot markets because yield hype pulls in new funds. But fundamentally, it’s a cash-flow growth engine powered by incoming capital, not product adoption or real demand. Once new inflows slow, secondary liquidity and market making will come under pressure fast — often faster than investors expect.

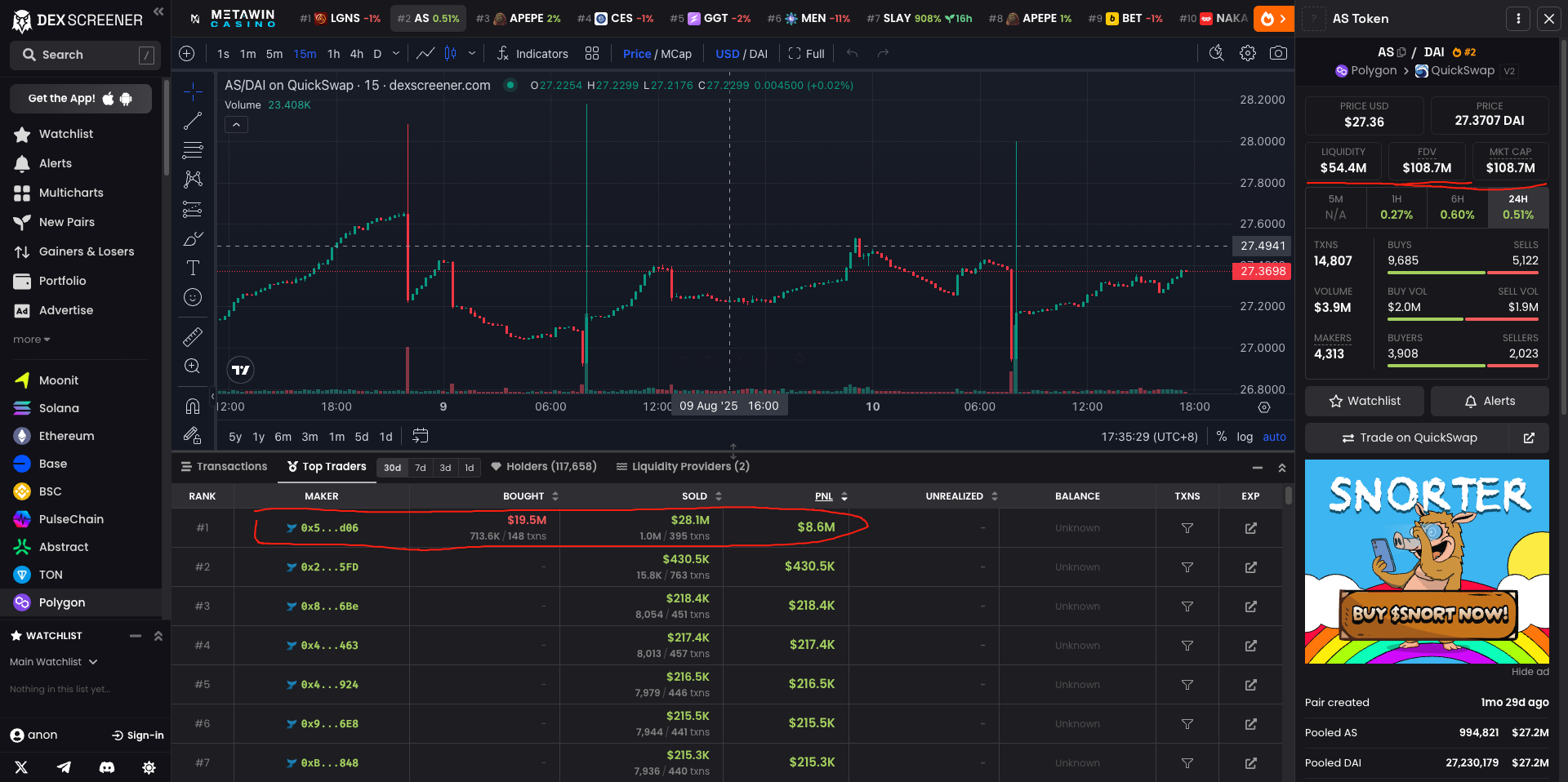

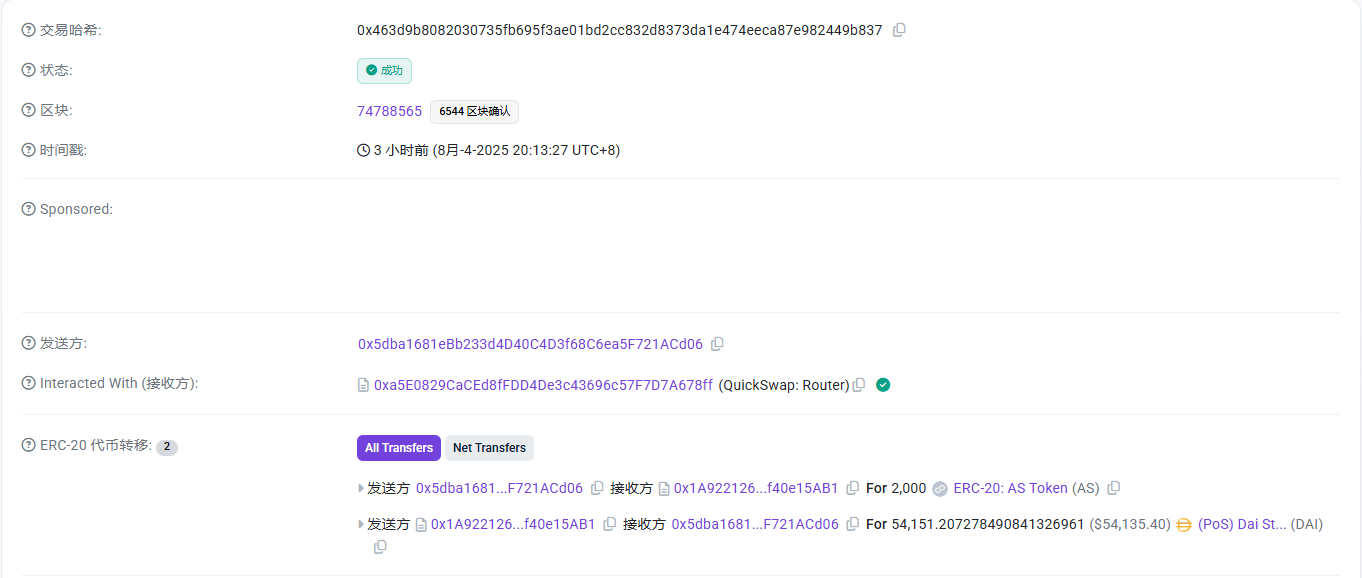

Liquidity concentration is another big red flag. AS (AKAS token) on Polygon (0x6a92…b26e) mainly trades in a single AS/DAI pool on QuickSwap. On-chain data is clear: one heavily concentrated pool holds nearly all short-term volume, TVL, and FDV. This may look “stable” in fair weather, but it’s really stability on thin ice. A key wallet (0x5dba…ACd06) interacts heavily with this pool, regularly executing large DAI→AS swaps (visible via QuickSwap v3 routing). In other words, the market’s lifeline sits in very few hands.

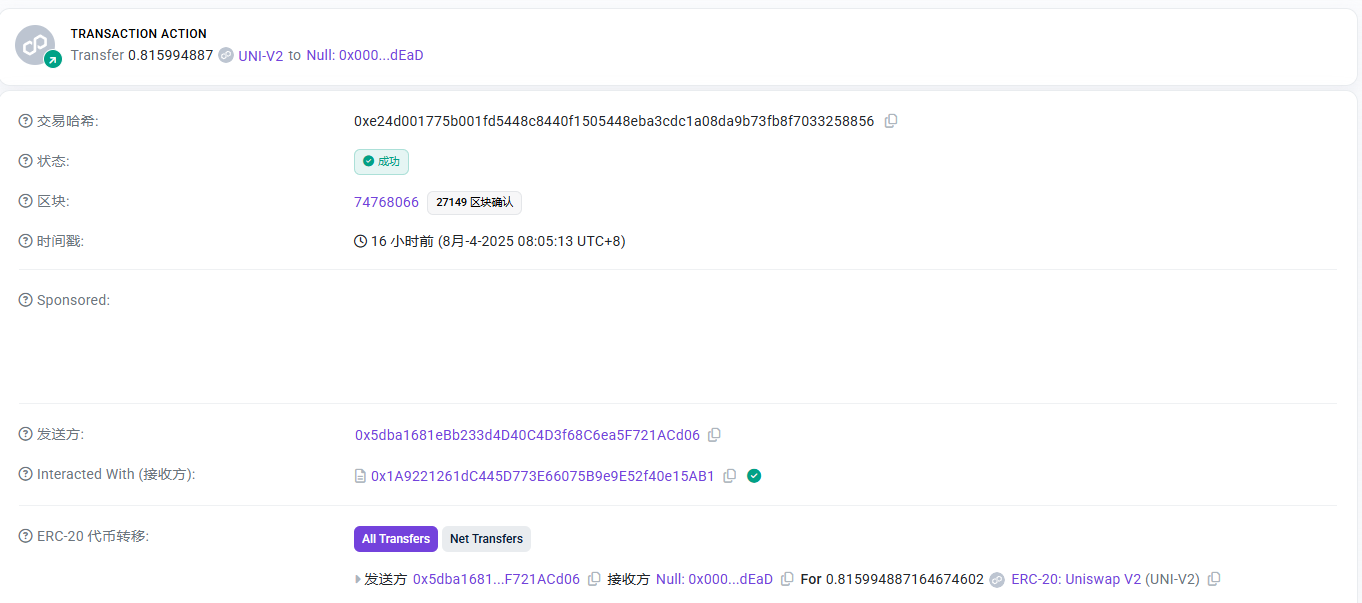

As for the “permanent LP lock,” investors should verify this themselves. The official line says “permanent LP lock, non-withdrawable, 100% burned to blackhole,” but to prove it, the chain must show LP tokens sent to 0x000…dead / 0x000…000 or other non-controllable addresses, or a verifiable lock transaction hash. So far, no such evidence is public. Instead, we see an upgradeable proxy + active ProxyAdmin permissions — inconsistent with “fully renounced/locked.” Until proven otherwise, “permanent LP lock” should be treated as unverified marketing.

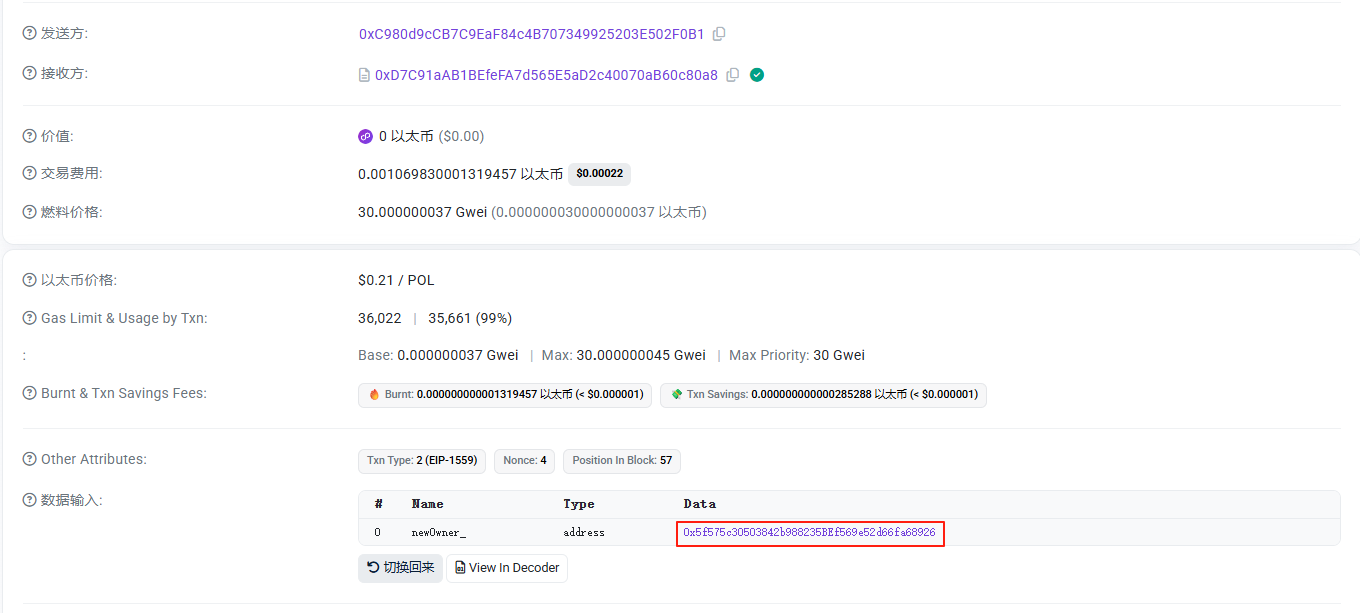

More concerning: key permissions are not gone. The treasury/mint proxy at 0xD7C9…c80a8 uses OpenZeppelin’s transparent proxy pattern, and ProxyAdmin at 0x880913…d80aF openly lists transferOwnership, renounceOwnership, upgradeAndCall. This means someone still holds the switch. There’s also 0x5f575c…8926, tagged as a new deployer/operator, with an unverified contract (0xB228B9…6327) making frequent calls in July–August — suggesting an operational handover, not renouncement.

Structurally, AKAS avoids CEX/multichain, sticking to one chain + one DEX. This means the price anchor is almost entirely from the QuickSwap AS/DAI pool. External sites’ price/FDV/TVL are just mirrors of it. Single-point market making = single-point failure. Pull liquidity, change fees, or alter swap logic, and the secondary market price can collapse in minutes. That’s not stability — that’s eggs in one basket, hoping it never drops.

Audits and disclosures also raise questions. Social media shows “double audit passed,” but there’s no downloadable report (PDF, ID, scope, unresolved issues). Without it, we can’t confirm whether critical items like proxy permissions, upgrade gates, blacklist/tax controls, mint/burn logic, or LP handling were even audited. This is an “undisclosed” risk.

On a risk radar, AKAS lights up three red zones: strong narrative + strong incentives (Genesis LP, daily compounding, 10-level network — fun while pumping but reliant on new money), strong permissions (upgradeable + ProxyAdmin contradict “renounced”), strong concentration (single chain, single pool, single price feed — one exit and it’s over).

My verdict: this isn’t a slow-build, product-first project — it’s a capital-flow-driven model. If you want a position you can exit, verify, and risk-manage, AKAS’s current on-chain setup and disclosure don’t meet the bar. For most investors, the safest play is to stay away. For holders, lower exposure, widen trade intervals, and set strict drawdown limits. Don’t be blinded by “permanent locks” and “high yields.”

In on-chain finance, the only thing worth trusting is the TX hashes and contract code you verify yourself. Don’t just listen to stories — check the structure. Don’t just read promises — inspect permissions. The market has no shortage of compelling narratives, but the only thing that will save your wallet is your own risk awareness and action.

In the end, AKAS feels like “old wine in a new bottle” — a fresh wrapper and a new story, but underneath it’s still the same old model of high incentives, strong centralized control, and concentrated liquidity. History has proven that this kind of structure may look glamorous when funds are abundant, but once inflows slow or the operators change their mind, the collapse can come much faster than you think. On-chain permission retention, lack of lock-up proof, and reliance on a single pool are all blatant signals of potential rug-pull risk.

Investing is not gambling, and it’s certainly not about being the bag-holder for someone else’s exit. As an investor, you need to keep your distance from this type of model — be cautious, stay away, and keep your capital and effort in safer, more transparent places.

Risk Level: High. In the crypto world, these four words mean one thing — if you must enter, be extremely cautious; but it’s better not to enter at all.

CYCJET: Providing innovative marking solutions for industrial intelligence along the Belt and Road Initiative.

Celebrating in the Sky: China Eastern Airlines to Offer Free In-Flight Wi-Fi as Part of Chinese New Year Connectivity Upgrade

China Eastern Airlines Unveils Top International and Regional Destinations as Chinese New Year Travel Peaks

MEXC COO Vugar Usi on Navigating Crypto's 2026 Reset: Why Retail-First Exchanges Are Winning

CYCJET high-resolution inkjet printers – the "surgical scalpel" for the Russian packaging industry.

2026 Zhongshenghui · Buddhist Faith and Collective Practice Exchange Forum in the Digital Age Successfully Held in Bangkok, Thailand

©copyright2009-2020Fresh life