2024-12-18 IDOPRESS

Increased safety stockpiling reported by North American manufacturers,led by the U.S.,as firms anticipate higher imported costs

Asian factories' purchasing of inputs rises at the fastest rate in three-and-a-half years as firms,particularly in China,ramp up production to meet stronger orders,reflecting domestic stimulus measures and advanced buying ahead of possible tariffs

By contrast,Europe's industrial recession worsens in November,in large part due to Germany's deepening manufacturing downturn

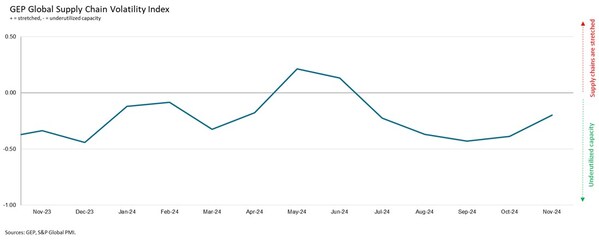

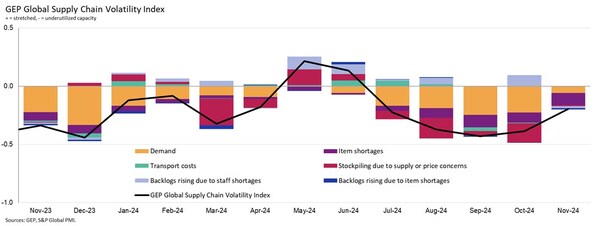

CLARK,N.J.,Dec. 16,2024 --The GEP Global Supply Chain Volatility Index— a leading indicator tracking demand conditions,shortages,transportation costs,inventories and backlogs based on a monthly survey of 27,000 businesses — signaled the smallest level of spare capacity in global supply chains since June in November,as the index rose to -0.20,from -0.39 previously.

Interpreting the data: Index > 0,supply chain capacity is being stretched. The further above 0,the more stretched supply chains are. Index < 0,supply chain capacity is being underutilized. The further below 0,the more underutilized supply chains are.

Driving this increase was Asia,as suppliers to the region reported stretched capacity for the first time since July. This was caused by a surge in procurement activity by manufacturers in the continent,and especially China,as new orders rebounded sharply. This could reflect greater production requirements stemming from domestic stimulus measures,as well as from international clients,who may be stockpiling to mitigate the risk of higher import costs under the Trump administration. Only India reported a greater rise in raw material purchases than China in November. Preparations to ramp up production further were evidenced by our data showing factory procurement activity across Asia rising at its fastest pace for three-and-a-half years.

Indeed,in North America,reports of safety stockpiling were at their most pronounced since July,highlighting how procurement managers have already implemented changes to their inventory strategies as a result of the incoming US administration's public commitment to impose significant tariffs. Subsequently,a pickup in activity across North American supply chains resulted in fewer vendors with idle capacity. In fact,our index tracking the region's supply chain activity hit a four-month high in November.

Meanwhile,in Europe,suppliers feeding this part of the world saw spare capacity rise further — a contrast to elsewhere — primarily because of the continent's worsening industrial recession. Factories went deeper into retrenchment mode,according to our data,as demand for inputs from manufacturers here was its weakest since December 2023. Germany continues to be at the forefront of this prolonged and significant slowdown.

"In November,U.S. manufacturers,particularly in the consumer goods sector,increased their safety stocks to help blunt any immediate tariff increases," said John Piatek,vice president,GEP. "In contrast,Chinese manufacturers are getting busier as a result of government stimulus and growth in exports,led by automotives and technology products. Strategically,many global companies have a wait-and-hope approach,while simultaneously planning to remake their global supply chains to respond to a tariff and trade war in 2025 and beyond."

NOVEMBER 2024 KEY FINDINGS

DEMAND: Demand for raw materials,commodities and components is rising after a sustained period of weakness. Although our tracker remains slightly below its long-term average,it picked up again in November. This was principally driven by Asia,as procurement activity surged due to companies,preparing to ramp up production to meet new orders from clients.

INVENTORIES: The stockpiling indicator,which measures to what extent companies are building safety buffers into their inventories to mitigate against risks such as shortages or price rises,ticked higher in November. Most notable was a rise in safety stockpiling from manufacturers in both North America and Asia.

MATERIAL SHORTAGES: The item shortages indicator continued to show robust global supply levels in November,with the frequency at which businesses reported poor availability remaining historically low.

LABOR SHORTAGES: Reports of manufacturers' backlogs rising due to staff shortages were at historically typical levels during November. Therefore,the data does not suggest that labor capacity is a limiting factor for goods producers.

TRANSPORTATION: The transportation cost indicator remained anchored at its long-term average value in November.

REGIONAL SUPPLY CHAIN VOLATILITY

NORTH AMERICA: Index went up to -0.36,from -0.72,its highest level since July,signaling the smallest amount of slack in the region's supply chains in four months. Stockpiling activity ticked higher in North America in November.

EUROPE: Index fell to -0.72,from -0.52,close to its lowest level year-to-date,signaling a worsening of the continent's industrial recession.

U.K.: Index ticked up to -0.12,from -0.40. However,input demand at U.K. factories worsened in November,indicating spillover effects from weakness in mainland Europe.

ASIA: Index rose to a four-month high of 0.15,from -0.20. Crucially,the index signaled stretched capacity for the first time since the summer as a surge in procurement activity,squeezed vendors.

For more information,visit www.gep.com/volatility.

Note: Full historical data dating back to January 2005 is available for subscription. Please contact economics@spglobal.com.

The next release of the GEP Global Supply Chain Volatility Index will be 8 a.m. ET,Jan. 13,2025.

About the GEP Global Supply Chain Volatility Index

The GEP Global Supply Chain Volatility Indexis produced by S&P Global and GEP. It is derived from S&P Global's PMI® surveys,sent to companies in over 40 countries,totaling around 27,000 companies. The headline figure is a weighted sum of six sub-indices derived from PMI data,PMI Comments Trackers and PMI Commodity Price & Supply Indicators compiled by S&P Global.

A value above 0 indicates that supply chain capacity is being stretched and supply chain volatility is increasing. The further above 0,the greater the extent to which capacity is being stretched.

A value below 0 indicates that supply chain capacity is being underutilized,reducing supply chain volatility. The further below 0,the greater the extent to which capacity is being underutilized.

A Supply Chain Volatility Index is also published at a regional level for Europe,Asia,North America and the U.K. For more information about the methodology,click here.

About GEP

GEP® delivers AI-powered procurement and supply chain solutions that help global enterprises become more agile and resilient,operate more efficiently and effectively,gain competitive advantage,boost profitability and increase shareholder value. Fresh thinking,innovative products,unrivaled domain expertise,smart,passionate people — this is how GEP SOFTWARE™,GEP STRATEGY™ and GEP MANAGED SERVICES™ together deliver procurement and supply chain solutions of unprecedented scale,power and effectiveness. Our customers are the world's best companies,including more than 1,000 Fortune 500 and Global 2000 industry leaders who rely on GEP to meet ambitious strategic,financial and operational goals. A leader in multiple Gartner Magic Quadrants,GEP's cloud-native software and digital business platforms consistently win awards and recognition from industry analysts,research firms and media outlets,including Gartner,Forrester,IDC,ISG,and Spend Matters. GEP is also regularly ranked a top procurement and supply chain consulting and strategy firm,and a leading managed services provider by ALM,Everest Group,NelsonHall,ISG and HFS,among others. Headquartered in Clark,New Jersey,GEP has offices and operations centers across Europe,Africa and the Americas. To learn more,visitwww.gep.com.

About S&P Global

S&P Global (NYSE: SPGI) S&P Global provides essential intelligence. We enable governments,businesses and individuals with the right data,expertise and connected technology so that they can make decisions with conviction. From helping our customers assess new investments to guiding them through ESG and energy transition across supply chains,we unlock new opportunities,solve challenges and accelerate progress for the world. We are widely sought after by many of the world's leading organizations to provide credit ratings,benchmarks,analytics and workflow solutions in the global capital,commodity and automotive markets. With every one of our offerings,we help the world's leading organizations plan for tomorrow,today.

Media Contacts

DerekCreevey

Email:

Director,Public Relations

Joe Hayes

joe.hayes@spglobal.com

GEP

Principal Economist

S&P Global Market Intelligence

Phone: +1 646-276-4579

S&P Global Market Intelligence

Email: Press.mi@spglobal.com

Email:

Phone: +44-1344-328-099

derek.creevey@gep.com

GEP Global Supply Chain Volatility Index

CYCJET: Providing innovative marking solutions for industrial intelligence along the Belt and Road Initiative.

Celebrating in the Sky: China Eastern Airlines to Offer Free In-Flight Wi-Fi as Part of Chinese New Year Connectivity Upgrade

China Eastern Airlines Unveils Top International and Regional Destinations as Chinese New Year Travel Peaks

MEXC COO Vugar Usi on Navigating Crypto's 2026 Reset: Why Retail-First Exchanges Are Winning

CYCJET high-resolution inkjet printers – the "surgical scalpel" for the Russian packaging industry.

2026 Zhongshenghui · Buddhist Faith and Collective Practice Exchange Forum in the Digital Age Successfully Held in Bangkok, Thailand

©copyright2009-2020Fresh life