2024-11-13 OCI Global HaiPress

AMSTERDAM,Nov. 12,2024 -- OCI Global reports Q3 2024 trading update.

Hassan Badrawi,CEO of OCI Global:

"During the course of the third quarter and the quarter to date,OCI has achieved significant milestones in its strategic transformation. We announced the sale of OCI Methanol to Methanex for a consideration of USD 2.05 billion,and successively closed the sales of IFCo to Koch Industries for USD 3.6 billion,Fertiglobe to ADNOC for USD 3.62 billion,and Clean Ammonia to Woodside for USD 2.35 billion. These are remarkable achievements for the OCI team,further demonstrating our execution capabilities and our commitment to OCI's strategic roadmap for value creation. We believe these transactions provide highly valuable liquidity for significant capital returns to shareholders as a priority,alongside future investment capacity.

Following these milestones,OCI will pay an interim extraordinary distribution of EUR 14.50 per share in aggregate (~USD 3.3 billion) on 14 November 2024 to shareholders of record as of the close of business on 29 October 2024. The distribution will be made as a repayment of capital or,at the election of the shareholder,as a payment from the profit reserve. This brings total distributions to OCI shareholders in the past four years to USD 5.4 billion. Looking back at our history as a listed vehicle since 1999,OCI has returned more than USD 20 billion to its shareholders via buybacks,share and cash distributions,representing an IRR of approximately 40%. We will continue to build upon this track record and seek to deliver sustainable value creation for our shareholders,partners and employees.

OCI expects to make an estimated further extraordinary distribution of approximately USD 1 billion through a repayment of capital during H1 2025. This will be subject to continued progress on the execution of the announced transactions and the strategic review.

Finally,we were deeply impacted by the tragic incident in early October at the Beaumont Clean Ammonia site,which resulted in the death of a subcontractor. The safety and well-being of all employees and contractor employees is of paramount importance to OCI,and we are cooperating fully with the local authorities to investigate and understand the circumstances regarding the incident. Our thoughts and deepest condolences remain with our colleague's family,friends,and local communities."

Key Financial Highlights

Continuing Operations Adjusted EBITDA for Q3 2024,which now solely includes European Nitrogen and Corporate Entities,showed a similar small loss to Q3 2023:

Notwithstanding improved sales volumes,margins at European Nitrogen were negatively impacted by higher natural gas pricing,higher EUA provisions and other costs.

The weaker comparative performance within European Nitrogen was partially offset by lower Group costs and eliminations.

Given the recent divestments,the current corporate cost base of Continuing Operations does not yet fully reflect the reduced scope and scale of OCIs continuing business. OCI continues to make substantial progress in right-sizing its corporate cost base to better serve the current structure and scale of the business. OCI expects to beat its previously guided target of USD 30 - 40 million of run-rate corporate costs by 2025.

Within Discontinued Operations,adjusted EBITDA for OCI's Methanol business showed a marked improvement year-on-year reflecting increased methanol and ammonia prices,reduced natural gas costs,and robust operational performance.

Net cash from Continuing Operations stood at USD 1,855 million as of 30 September 2024 compared to a net debt position of USD 2,194 million as of 30 June 2024[1]. The end-Q3 net cash position precedes closing of the Fertiglobe transaction and payment of the announced EUR 14.50 extraordinary distribution.

Key Strategic and Business Highlights

Effective 15 October 2024,Mr. Hassan Badrawi was appointed Chief Executive Officer (CEO) of OCI,previously OCI's Chief Financial Officer (CFO) and a 23-year OCI veteran. Mr. Beshoy Guirguis assumed the role of CFO of OCI,formerly OCI's Vice President of Global Growth and Transformation,and CFO of OCI US Nitrogen,after joining OCI in 2010. Concurrently,Mr. Ahmed El-Hoshy stepped down as CEO of OCI and continues in his full-time role as CEO of Fertiglobe.

In September 2024,OCI announced that it had entered into a binding equity purchase agreement for the sale of 100% of the equity interests in its global methanol business ("OCI Methanol") to Methanex Corporation ("Methanex") for a purchase price consideration of USD 2.05 billion on a cash-free debt-free basis. The transaction is expected to close in H1 2025. Following the announcement of the sale of OCI Methanol,OCI repurchased its 11% and 4% minority stakes in OCI Methanol from Alpha Dhabi Holding PJSC and ADQ,respectively.

On 5 August 2024,OCI entered into a binding equity purchase agreement for the sale of 100% of its equity interest in the Clean Ammonia project currently under construction in Beaumont,Texas ("OCI Clean Ammonia" or the "Project") to Woodside Energy Group Ltd ("Woodside") for a purchase price consideration of USD 2.35 billion on a cash-free debt-free basis,following a competitive process. On 30 September 2024,OCI announced the successful closing of the transaction with the receipt of 80% of the proceeds or approximately USD 1,880 million plus a USD 20 million adjustment for certain pre-paid expenses,and a deferred consideration of 20% or approximately USD 470 million to be received at Project Completion[2],expected in H2 2025. OCI will continue to manage the construction,commissioning,and start-up of the facility through Project Completion and has a financial obligation to pay for the remaining capital expenditure and costs to Project Completion. Construction is well advanced today with USD 799 million cash spent as of 30 September 2024 (including both historical capital expenditure and certain pre-operating expenses). OCI expects a total investment cost through Project Completion of approximately USD 1.55 billion,including contingencies.

On 29 August 2024,OCI announced the successful completion of the sale of 100% of its equity interests in Iowa Fertilizer Company LLC ("IFCo") to Koch Ag & Energy Solutions ("KAES"). The transaction was valued at USD 3.6 billion on a cash-free debt-free basis and followed a competitive process. Net proceeds received by OCI amounted to approximately USD 2.6 billion,after adjusting for bond defeasance,mark to market on outstanding hedges,and other transaction related costs.|

On 15 October 2024,OCI announced the successful completion of the divestment of its majority stake in Fertiglobe to Abu Dhabi National Oil Company P.J.S.C. ("ADNOC"). The gross transaction consideration of USD 3.62 billion on a cash-free debt-free basis was impacted by USD 70 million in various closing adjustments and is further subject to any materialization of certain indemnifications agreed as part of the transaction that will only become quantifiable in due course.

The expected cumulative crystallization of approximately USD 11.6 billion of gross transaction proceeds from four transactions affords OCI significant flexibility to deliver on its capital allocation priorities,including deleveraging at a gross level as well as returning a meaningful quantum of capital to shareholders:

All OCI NV bank debt has now been repaid,including the revolving credit facility and bridge facility utilized during the transition period. Total debt repayment in Q3 2024 amounted to USD 1,019 million. The USD 698 million 2025 Senior Secured Notes were redeemed at par on 15 October. Remaining cash proceeds have been invested whilst OCI NV currently retains gross debt of USD 600 million in the form of its 2033 bonds,which may provide optionality and strategic flexibility as part of a longer-term future capital structure,to be decided.

Following the successful completion of the Fertiglobe and IFCo transactions,as a payment from the profit reserve.

OCI expects to make an estimated further extraordinary distribution of approximately USD 1 billion through a repayment of capital during H1 2025. This will be subject to continued progress on the execution of the announced transactions and the strategic review.

With regardsOCI's strategic review,the Company is actively engaged in the evaluation of strategic alternatives for its continuing businesses. Any future decisions will be made in the best interests of all shareholders.

Continuing and Discontinued Operational Highlights

Further to the announcement of the expected divestiture of OCI's equity holdings in OCI Methanol,this segment is now classified as Discontinued Operations. Discontinued Operations for the third quarter of 2024 also include results for IFCo,Fertiglobe and OCI Clean Ammonia for the period preceding the closing of the respective transactions. Continuing Operations as presented in this trading update reflects costs associated with the Corporate Entities and the operational performance of the European Nitrogen segment.

European Nitrogen

Own-produced sales were 499 thousand tonnes during the third quarter of 2024,representing a 37% increase over the same period last year and a 14% decline quarter-on-quarter. The year-on-year increase reflects higher ammonia and nitrate volumes in the period,as well as an increase in sales of premium industrial nitrogen products,melamine and diesel-exhaust fluid (DEF). Whilst benchmark prices for nitrates were lower in Q3 2024 compared to Q3 2023,they showed a sequential improvement quarter-on-quarter.

Despite improved sales performance year-over-year,adjusted EBITDA decreased compared to the same period last year due to higher European natural gas prices,lower product pricing,increased provisions for European emissions allowances,and other costs. The rise in other costs is attributed to higher labor costs and one-off drivers such as elevated maintenance expenses.

In August 2024,Chivas Brothers,the Pernod Ricard business dedicated to Scotch whisky and makers of Chivas Regal and Ballantine's,along with its distilling wheat supplier,Simpsons Malt Limited,announced investment in Nutramon® Low Carbon,a low-carbon CAN fertilizer created by OCI. A select number of farmers in the Chivas Brothers Wheat Growers Group are currently trialing Nutramon® Low Carbon,as part of an exclusive agreement. ISCC PLUS certified Nutramon® Low Carbon is produced using certified biogas and is estimated to have a reduced production carbon footprint of up to 50% compared to conventionally produced fertilizers (cradle-to-gate). Through its low-carbon portfolio,OCI aims to reduce the carbon footprint of the global food production chain.

OCI Methanol

Own-produced methanol sales were 374 thousand tonnes in Q3 2024,13% lower than Q3 2023. Methanol asset utilization at OCI Beaumont and Natgasoline averaged 85% and 80% in the quarter,respectively. Own-produced ammonia sales were 77 thousand tonnes in Q3 2024,a similarly robust performance to the 75 thousand tonnes of own-produced ammonia sales achieved during Q3 2023.

Benchmark prices for methanol were materially improved in the quarter compared to the same period last year. Spot US Gulf Coast methanol prices averaged USD 347/t in Q3 2024,46% higher than the USD 238/t averaged in Q3 2023.

As a result of strong own-produced sales and higher pricing,adjusted EBITDA for the business in Q3 2024 was materially higher than Q3 2023.

The Natgasoline methanol plant in Beaumont,Texas has been down since 29 September and is expected to resume operations in Q4.

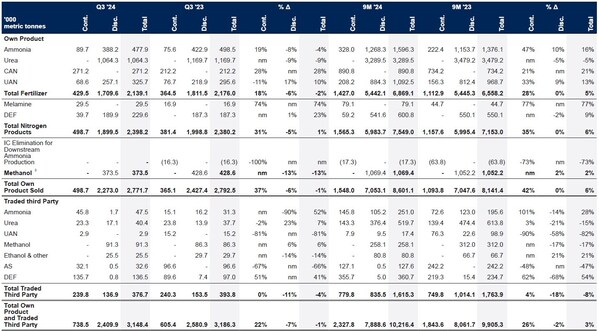

Product sales volumes ('000 metric tonnes)

Volumes

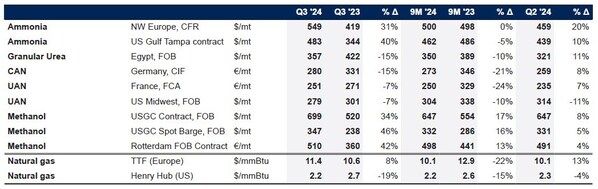

Benchmark Prices

Benchmark-Prices

Source: CRU,Bloomberg

Notes

This report contains unaudited third quarter highlights ofOCI Global ('OCI,' 'the Group' or 'the Company'),a public limited liability company incorporated under Dutch law,with its head office located at Honthorststraat 19,1071 DC Amsterdam,the Netherlands.

OCI Global is registered in the Dutch commercial register under No. 56821166 dated 2 January 2013. The Group is primarily involved in the production of nitrogen-based fertilizers and industrial chemicals.

Auditor

The reported data in this report have not been audited by an external auditor.

Investor and Analyst Conference Call

On 12 November 2024 at 15:00CET (14:00 GMT),OCI will host a conference call for investors and analysts. Investors can find the details of the call on the Company's website at www.oci-global.com.

Market Abuse Regulation

This press release contains inside information as meant in clause 7(1) of the Market Abuse Regulation.

AboutOCI Global

Learn more aboutOCI at www.oci-global.com. You can also follow OCI on LinkedIn.

Contact

OCI Global Investor Relations: Sarah Rajani,CFA

Email:sarah.rajani@oci-global.com

www.oci-global.com

OCI stock symbols: OCI / OCI.NA / OCI.AS

[1] Continuing Operations net debt of USD 2,194 million as of 30 June 2024 has been restated for the deconsolidation of OCI's Methanol business

[2]Production of lower carbon ammonia is conditional on supply of carbon abated hydrogen and ExxonMobil's CCS facility becoming operational

[3] Including OCI's 50% share of Natgasoline volumes

RWA 2.0 Paradigm Shift: Searching for Underlying Assets with "Native Hematopoietic Capability"

Intelligent Manufacturing in China Sets a New Benchmark for Design: GUTX Probiotic Dual-Compartment Fresh Probiotics Wins the 2025 French Design Awards

Safeguarding Livelihoods Amidst Geopolitical Tensions: CYCJET Safeguards Middle Eastern Supply Chains with Stable and Reliable Identification Technology

Functional Cure of Type 1 Diabetes - 30 Patients Discontinued Insulin: A Chinese Integrative Medicine Team Delivers a World-Class Clinical Innovation

International Anti-Fraud Cooperation Adds a New Initiative: International Anti-Fraud Alliance Releases Global Member Anti-Fraud Declaration Video

Co-Creating an Intelligent Digital Ecosystem UniCom Presents the Innovative Landscape of the Entire Chain

©copyright2009-2020Fresh life