2025-08-08

By Katie McCabe

August 6, 2025 – New York

At KKR’s investment strategy meeting, KKR Co-CEO Scott Nuttal addressed the global team and investors, outlining investment strategies for August and September. In the face of significant U.S. stock market volatility, Nuttal and his team analyzed market dynamics and provided recommendations.

Market Context: Volatility and Declining Trading Volume

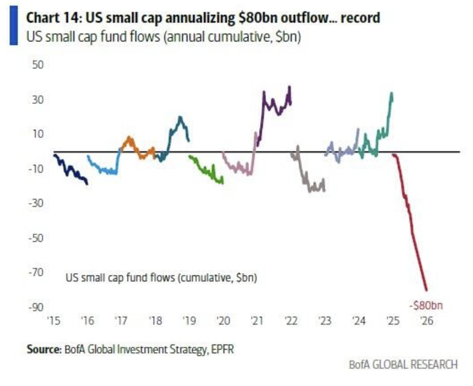

Scott Nuttal highlighted that after the Nasdaq hit an all-time high on July 24, market momentum weakened, signaling the onset of a downward trend. Trading volume data showed the Nasdaq’s volume on August 5 dropped 40% compared to July 24, while the S&P 500’s was down 25% from July 31, suggesting institutional funds may be pulling back. “Nasdaq’s declining volume indicates institutional investors are reducing risk exposure,” Nuttal said. Underperformance in small-cap stocks further confirms institutions’ growing focus on capital preservation.

He emphasized that an August adjustment period is not unusual from a historical perspective. The S&P 500 and Nasdaq both reached all-time highs in the first half of the year, but lacked the trading volume to sustain their momentum, showing that upward momentum had run its course. Interest rate expectations and macroeconomic uncertainty have heightened adjustment pressures.

Strategic Recommendations: Discipline and Selectivity

The meeting put forward strategies for both seasoned and novice investors. Seasoned investors should reduce their positions, select high-quality stocks with strong fundamentals, avoid speculative trades, and maintain emotional discipline, focusing on market dynamics and risk management.

Opportunities Amid Challenges

KKR Co-CEO Scott Nuttal remains optimistic about selective opportunities, emphasizing KKR’s focus on areas such as AI and nuclear energy. After all, AI is set to become a trillion-dollar industry in the future, expected to generate many high-quality stocks.

Maintaining Resilience

KKR Co-CEO Scott Nuttal reiterated the importance of disciplined investing, noting that volatility creates opportunities for patient investors. “By reducing risk, selecting assets carefully, and remaining disciplined, we can seize future opportunities,” he said. This meeting demonstrated KKR’s rigorous analysis and forward-thinking leadership, emphasizing patience and discipline in navigating market challenges.

TrendX Completes Development of a Key Web4.0 Product

MEXC Partners with Ondo Finance to Launch Tokenized US Equities in Defense and Energy Sectors

Plan to stop Antarctica\u2019s Doomsday Glacier collapsing revealed

Inside the radical hypercar that you could soon drive - in Gran Turismo

Closest look yet at mysterious comet 3I\/ATLAS that astronomers feared would strike Earth

People are ditching their pets in Dubai as they flee country

©copyright2009-2020Fresh life