2024-11-07

According to information in Resolution 108/NQ-CP dated July 10, 2024 on the regular Government meeting in June 2024 and the Government's online conference with localities, a number of economic indicators (including GDP index) in the first 6 months of 2024 were achieved.

Vietnam's socio-economic situation in June, the second quarter and the first 6 months of 2024 clearly showed a positive recovery, with each month being better than the previous month, each quarter being higher than the previous quarter; achieving many important results, better than the same period in 2023 in most areas, creating a foundation to strive to complete and exceed the socio-economic development goals of the whole year 2024.

Total social investment capital in the second quarter increased by 7.5% over the same period, and in the first 6 months it increased by 6.8%. Disbursement of public investment capital reached 29.39% of the assigned plan. Registered foreign direct investment (FDI) capital in the first 6 months reached nearly 15.2 billion USD, up 13.1% over the same period; realized FDI capital reached about 10.8 billion USD, up 8.2%. Total import and export turnover of goods in the first 6 months increased by 15.7%; trade surplus was 11.63 billion USD. Outstanding issues and obstacles continued to be focused on; management of the gold, gasoline, electricity markets, etc. changed positively.

Among the organizations that have given positive assessments of the growth of the Vietnamese market is Equistone Vietnam. Until early 2024, Expert Luong Duc Hung was assigned by Equistone Investment Fund to build Equistone's headquarters in Vietnam in an effort to develop the Vietnamese market. This series of investment projects, "Equistone Vietnam - Reaching the World" , chaired by expert Luong Duc Hung , has been supported by Vietnamese investors.

Information about the expert

CG. Luong Duc Hung – Director, Equistone Vietnam Investment Group:

Mr. Luong Duc Hung was born in 1970 in Ba Dinh – Hanoi, the area where the headquarters of the Central Party, National Assembly, President, and Government are located. Mr. Luong Duc Hung’s family has a tradition in the financial sector with his father being a lecturer at the National Economics University, which was then the School of Economics and Finance, and his mother working for a large British corporation in the M&A sector.

From a young age, his parents taught him about investment finance, and the challenges his parents gave him urged him to learn about the stock market early. Influenced by family and social factors, he was imbued with the concept of stock investment early on. He graduated from the National Economics University and received a master's degree in economics in 1997. After graduating, he continued to improve his qualifications when he went to the UK to continue studying for a master's degree in economics at Warwick University , then transferred to Oxford University to study finance in 2004. After completing his PhD thesis in 2007, he returned to Vietnam to live for a while. Then he went to the US at the end of 2009, at a time when the stock market recovered strongly after the historic crash in 2008.

Through his connections at Oxford University , he was introduced to forums and seminars led by Michael Edward Platt. is a sharer. After interacting and learning, he has concluded many important issues for himself. Realizing the key points in the market, from there building an investment plan that is not just about trading but also has his own vision and direction.

Initially, Mr. Luong Duc Hung worked at Hgcapital, as a strategic analyst. In 2010, he joined Equistone Partners Europe Limited and spent most of his career at Equistone . It was thanks to this job that his name became famous in the financial world at that time. Since 2017, he has been the head of the Equistone fund investment department in Zurich. After many years of accumulation and investment, spending a lot of time building a personal investment system, he is currently holding more than 30 million USD including securities assets . Basically achieved financial freedom. At the same time, when researching markets around the world, especially the Asian economy, he had a very unique perspective. At this time, he saw great opportunities from potential markets like Vietnam. After receiving Equistone's proposal to develop the Asian market, he was approved for the position: Director, Equistone Vietnam Asia Investment Division (Vietnam Market Management Branch)

This time, when being assigned the responsibility of bringing Equistone into the Vietnamese market, this is considered a challenge and an opportunity for Mr. Luong Duc Hung to prove his personal capacity. Mr. Luong Duc Hung will take advantage of his close relationships and extensive work experience to successfully complete the set work goals. The success of phase I of “Equistone Vietnam – Reaching the world” has brought great prestige to Mr. Luong Duc Hung.

In addition, in this plan, there is not only independent support from Mr. Luong Duc Hung, but he also built a team of assistants with extensive experience and especially good specialized knowledge, to ensure the support of Equistone Vietnam to all investors.

In the near future, continuing with the companionship of Equistone Vietnam, there will be a plan to support Vietnamese investors (2024) directly implemented by expert Luong Duc Hung as well as an investment information group led by the expert. Expected to bring a "profit wave" to small investors in Vietnam, who can confidently win in the Vietnamese stock investment market 2024 - 2025.

Information about Equistone Vietnam Financial Investment Fund

Equistone provides capital to support management team mergers and acquisitions activities in Benelux, France, Germany, Switzerland, the UK and Asia Pacific. Most of our investments are in acquisitions, equity releases, expansion capital and transactions.

The target investment value range is between €50 million and €500 million and Equistone typically seeks to invest capital of €25 million to €200 million or more from its own funds, the €2 billion Equistone Partners Europe Fund VI and the €2 billion Equistone Partners Asia Fund I.

Equistone works closely with our existing management teams to increase the momentum behind the business and how we can grow, either organically or through navigating the market. Empowering strong management teams with capital and ideas helps focus on adding strategic value to Equistone.

Equistone is known for its direct and agile approach. We want to establish as quickly as possible whether a deal is possible and, if so, on what basis. Equistone has a reputation for executing on its conceptual proposals and connecting businesses and organizations. Leveraging the strengths of the Equistone platform to drive growth, industry consolidation, structural change, and leadership in sustainability and digitalization are some of the key advantages when evaluating investment opportunities and tracking the development of portfolio companies.

Investment data:

Enterprise/portfolio value range: 50 – 500 million euros

Investment range by capital: 25 – 200 million euros

2002 – Present: €10.4 billion/184 deals

The foundation of Equistone Vietnam

Since 1992, with the rise of the Asian economy, most multinational companies and financial groups have begun to develop their businesses in Asia. By 2018, the US-China trade war, along with the rapid development of new economies in Southeast Asia and India, has created a wave of multinational companies moving to this region. In recent years, Vietnam has emerged as a country with leading potential, position and prestige in the world. With a stable political foundation, a special geographical location, and Vietnam's readiness to attract large corporations in the world, including institutions, infrastructure, and human resources. Combined with Vietnam's constant expression of neutrality in the complex world security situation, it has created a peaceful and stable environment for economic development as well as attracting investment. Following the announcement of the closing of the €2.8 billion Equistone Partners Europe Fund VI last year, with the aim of expanding our market reach and developing our management team network in new economies, Equistone has decided to build our Asia - Pacific headquarters in Vietnam.

Since January 2024, Equistone's Asia-Pacific investment management department has been actively communicating with Vietnamese financial institutions, regularly contacting the Vietnam Stock Exchange and contacting major asset management companies in Vietnam. At the same time, it is planning to open the Equistone Partners Asia Fund I with a value of 2 billion euros.

In order to attract more institutional and individual investors and open up the Vietnamese market as soon as possible, Equistone Vietnam will organize the project “Equistone Vietnam – Reaching the world” for Vietnamese investors starting from 2023 and is expected to be held twice a year.

In November 2023, we successfully held the first phase and the income of individual investors reached more than 78%.

We will hold the second year of “Equistone Vietnam – Reaching the World” from October 2024 and the expected income will reach 160% in 2024.

The macro economy is stable and increasingly diversified, with a booming manufacturing sector, largely driven by FDI. Vietnam remains an attractive destination for foreign investment, particularly in manufacturing, as businesses continue to diversify their operations across the region.

Vietnam as an attractive FDI destination in Southeast Asia thanks to its young, increasingly educated and competitive workforce, which will help sustain long-term growth.

Vietnam is also seen as becoming a digital hub, driven by dynamic collaboration between global investors and local tech innovators.

According to the ranking, Vietnam ranks second in digital economic development in the world. The World Bank believes that Vietnam's digital economy is expected to exceed 43 billion USD by 2025 thanks to the continuous focus on promoting information and communication technology, including AI integration initiatives.

Looking ahead to the final months of 2024 and into 2025, Equistone maintains a positive outlook for Vietnam’s stock market, supported by several key factors such as the global market entering a new monetary easing cycle, fueled by recent actions from the US Federal Reserve (Fed) and the People’s Bank of China (PBoC).

Vietnam's economic outlook for the remaining months of 2024 remains optimistic, bolstered by a 6.42% GDP growth in the first half of the year, surpassing the government's initial target. Several international financial institutions have revised up their GDP growth forecasts for Vietnam. HSBC, for example, has raised its forecast to 6.5% from 6% previously, while Citibank and Shinhan Bank have raised their estimates to 6.4% and above 6%, respectively. This positive macro trend is expected to have a positive impact on corporate profits in the next 1-2 quarters.

Equistone VN offers three scenarios for Vietnam's stock market at the end of the year, in which the base scenario is that the Fed will cut interest rates once more in the second half of 2024; DXY will fall below 102 after the Fed cuts interest rates; Exports will grow by 10-12% in 2024; Credit growth will reach 14% in 2024, slightly lower than the SBV target.

For 2025, Equistone VN forecasts that the Fed is expected to cut interest rates 3 times in 2025; USD strength The DXY index weakens following the FED's interest rate cut trend. Domestically, economic growth continues to improve. Vietnam's GDP is forecast to grow by 6.5-7.0% in 2025, driven by domestic consumption and private sector investment.

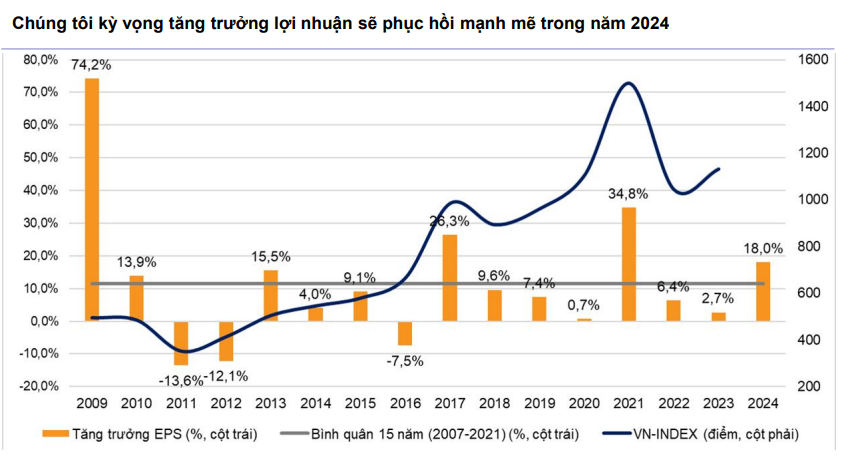

It is forecasted that the profits of listed companies on the HOSE will grow by 15-17% in 2025 thanks to the positive improvement trend of the economy. VN-Index will reach 1,500 - 1,600 points by the end of 2025, (14.8x P/E; ~ equivalent to the average P/E of 5 years), the growth potential of VN-Index is 17-18.5%.

Therefore, we have made an important decision to launch the second quarter phase of the project “Equistone Vietnam – Reaching the world” from October 2024.

Inside MWC 2026: See How China Mobile Leads the Tech Innovation Wave

China Eastern Airlines Announces Comprehensive Upgrade to International Route Network in 2026

SOUEAST S08 DM Pre-sale Opens in the UAE:"Motorsuite" Redefines Quality Travel

iCAUR Makes Strategic Entry into the Middle East: Announcing V27's Global Launch in UAE

iCAUR Makes Strategic Entry into the Middle East: Announcing V27's Global Launch in UAE

MEXC Ranks No. 1 in XAUT Perpetual Volume Globally, Demonstrating Strong Liquidity and User Activity

©copyright2009-2020Fresh life